Artificial intelligence (AI) has been revolutionizing the financial industry, offering new opportunities and challenges for CFOs (Chief Financial Officers).

Unlike other business areas, such as Human Resources, financial departments are more cautious about adopting these new technologies. According to Gartner, AI in the financial area is growing rapidly, but starting from a very small base. Furthermore, only 30% of Gartner respondents (with finance roles) are leading the AI process in their organizations.

AI has radically transformed the way financial institutions operate, enabling process automation, advanced data analysis, and the personalization of services. According to Gartner, AI is becoming a fundamental part of innovation and competitiveness in the financial sector, with the potential to optimize operations, reduce costs, improve decision-making, and drive growth.

In this article, we will identify the four critical areas that CFOs should focus on for a solid strategy for implementing AI in finance, based on valuable insights from sources such as Gartner, Forbes, and the World Economic Forum.

Recruit or identify AI talent internally

Top CFOs are looking for “generation AI” (talent who are developing, implementing, or championing the first wave of AI solutions) to fill roles that contribute to successful financial AI implementations.

The financial return on implementing artificial intelligence in the financial area is still low due to insufficient skills in this area and the reluctance of many employees to adopt it.

To attract this talent, it is necessary to adjust recruitment strategies, invest in training in this field for current employees, and invest in tools that allow the creation of an innovative, disruptive environment with an enormous quality of financial data.

Position finance for AI success

For a manager focused on productivity, AI outputs, similar to those of humans, present obvious benefits. However, employees perceive AI in the financial area as a threat to their jobs.

Gartner research reveals that 70% of active employees believe AI can replace people, so it’s not surprising when new AI-based solutions are rejected or fail to gain traction. Naturally, blindly giving responsibilities to machines is inadvisable. AI-supported processes must be transparent and allow people to observe and control them whenever necessary.

It is therefore crucial to keep humans involved (humans in the loop) so that they can monitor and interrupt automated processes whenever necessary, taking measures that require human criteria. Furthermore, CFOs must position AI as a co-worker that helps employees and is not a threat to their jobs.

Organizations that prioritize AI solutions that improve employee productivity are six times more likely to see their AI initiatives succeed.

Lead the organization's debate on the impact of generative AI.

There are currently many generative AI solutions, which is why it is essential to consider their risks and impacts. CFOs must speak to technology leadership (CIO, CDO, and CISO) to distinguish fads from future-proof solutions.

Aligned and actionable cases for generative AI must be defined. The best use cases reinforce a company’s strengths and protect its weaknesses. It is crucial to align the capabilities of generative AI with each company’s unique strategies and objectives to deliver value that differentiates it from its competitors.

Finally, it is necessary to involve the company’s top management (legal functions, HR, audit, security, among other relevant business support functions) to develop the common thread and governance and mitigation of the risks of generative AI:

- Ensure ethical use and reduce excessive dependence on algorithms that may not always be accurate;

- Minimize legal and compliance risk;

- Establish transparent and responsible implementations;

- Protect against reputational damage and financial misrepresentation;

- Check the results;

- Understand the potential impact on the workforce, company culture, and required training.

Source: Gartner

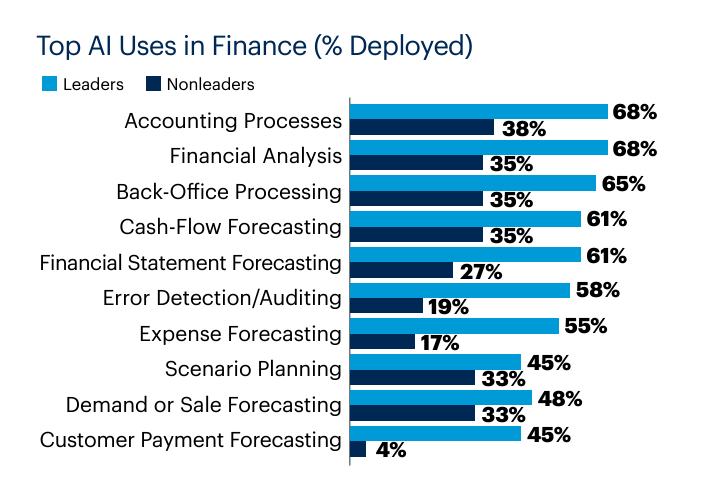

AI use cases in finance

The Gartner study reveals that 61% of financial organizations surveyed do not yet use AI, are still in the implementation planning phase, or do not have any plans at all. Only 9% of companies are using and expanding AI in the financial area, far behind other administrative functions such as HR, legal, real estate, IT, or purchasing. The main reasons are “other priorities” (the main reason), “lack of technical capabilities," “poor quality data,” and “insufficient use cases.”.

However, AI can be a critical enabler of the “priorities” of financial departments, particularly in terms of financial planning or the efficiency of closings and consolidations.

This is attested to by 64% of financial organizations that use AI and report that its impact has met or exceeded their expectations.

One of the use cases already in use on Uniksystem’s automation platforms is Accounts Payable automation, which completely eliminates the need for manual data entry in financial ERPs with the extraction of data from financial documents and the application of automatic rule validation and approval.

Lessons to learn from those who lead change

In another document, “4 AI Implementation Lessons From Leading Organizations”, Gartner identified organizations that are currently leading the best AI implementations as well as the decisions made to achieve success. These companies, in a leadership position, meet the following criteria:

- AI initiatives are evolving as quickly or faster than anticipated;

- AI initiatives that are having more impact than anticipated;

- Financial function results delivered (e.g., greater accuracy, faster processes, etc.);

- Business results delivered (e.g., new product introduction, monetization, etc.)

These are companies that invested in specific processes or capabilities and quickly experimented with them, namely in three specific actions:

1 – Buy technology with AI capabilities for greater impact

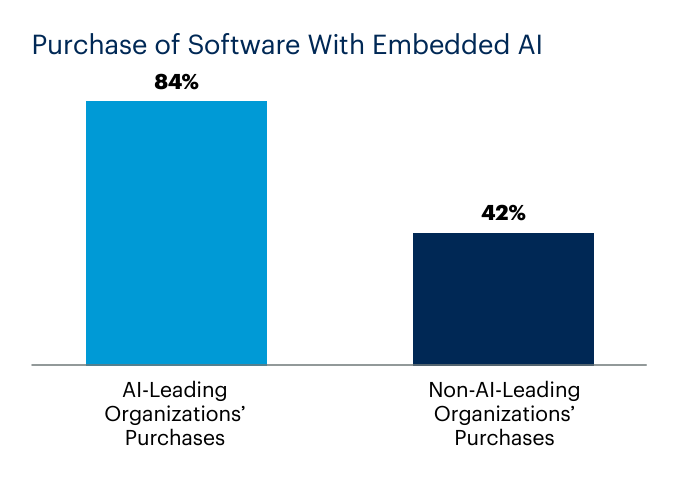

84% of the most advanced companies adopting AI in the financial area purchased technology already prepared for AI. Purchasing software with built-in AI capabilities allows companies to more easily experiment with AI and apply it to more financial use cases. Teams can more easily build pilots for problems unique to their business.

Source: Gartner

Source: Gartner

2 – Experiment early and deeply with early pilots to create efficiencies

Organizations leading the adoption of AI in finance developed twice as many pilots during the first year as the rest of financial organizations. The benefits of experimenting early include strengthening an environment for experimentation that allows departments to consider developing new AI projects in other areas and understand that, with AI in its infancy, not all pilots will be successful.

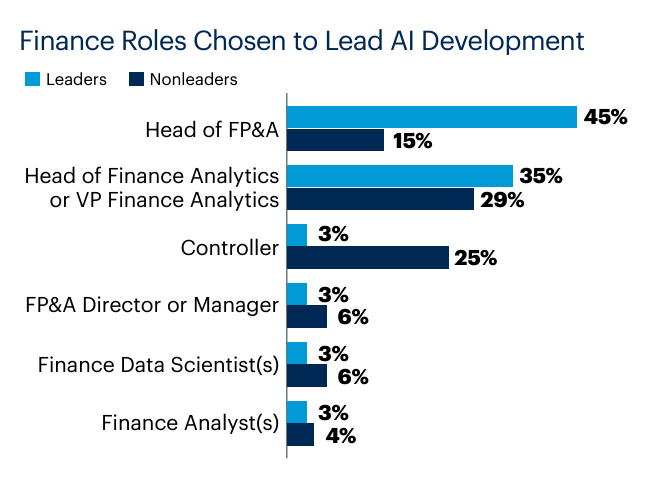

3 – Choose an analytical AI leader to transform the business

Choosing the right person to lead AI in the financial area is fundamental. These professionals must have strong analytical skills and a data background. They would rather understand the complexities of AI in a business scenario than traditional financial processes.

Source: Gartner

What should be considered when implementing AI in the financial area?

Unlike automation software that can do simple, routine tasks, AI performs tasks that historically could only be handled by humans. This positions AI more as a co-worker than other technologies.

But despite AI’s capabilities, finance departments have unique responsibilities, such as validating the integrity of financial statements, that cannot be delegated to an algorithm.

When building AI-driven processes in finance, CFOs must design solutions with complete transparency so that the humans with these responsibilities can remain fully informed and accountable.

Prepare to be impressed

Fortune reached out to six CFOs and industry experts to preview what will change corporate financial management with AI. “Prepare to be impressed,” MIT researcher Michael Schrage told Fortune.

Within a year, “we will see the ability of Retrieval Augmentation Generation (RAG) to transform financial dashboards into recommendation engines, “providing information, forecasts, and advice in real time to help those who budget and forecast the future improve their numbers.”.

CFOs must work as if transactional processes, reporting, and reconciliation are highly intelligent and predominantly automated by AI and ML. They must therefore understand how their talents will interact with these systems to signal the skill sets needed in the future and to redefine the talent strategy.

Michael Tannenbaum, CFO-COO at Brex, anticipates 2024 will be a turning point for AI; it will no longer be a promise. “AI will have a real impact on business operations. AI is the perfect solution for a macro environment looking to reduce costs while making employees more productive.”

Will your organization be left behind?

by Ricardo Barros – Chief Customer Success Officer @Uniksystem

Share!